Astrological Market Risk Analysis: Mercury Retrograde 2026, Rahu in Aquarius, and Volatility Triggers

Executive Summary

The year 2026 presents a rare clustering of astrological and geopolitical variables associated historically with heightened market instability. These include:

-

Three Mercury retrograde and combustion phases totaling ~59 cumulative days

-

All occurring in air signs (Aquarius, Gemini, Libra)

-

Rahu transiting Aquarius for the broader cycle (2025–2026)

-

A Solar Eclipse (Feb 17, 2026) and Lunar Eclipse (Mar 2–3, 2026) within the first retro window

-

Escalating geopolitical tensions surrounding U.S.–Iran relations entering the eclipse corridor

This study does not propose deterministic crash prediction. Instead, it classifies 2026 as a structurally elevated volatility environment, particularly in information-driven and liquidity-sensitive sectors.

1. Methodological Framework

This research integrates:

-

Classical Vedic astrology principles

-

Historical market event observation

-

Behavioral finance correlations

-

Geopolitical timing analysis

-

Eclipse and collective sentiment modeling

Primary astrological thesis:

When Mercury (trade, information) is retrograde and combust during Rahu’s transit in Aquarius (technology, narratives, networks), markets show increased susceptibility to mispricing and behavioral swings.

2. Classical Foundation: Mercury Retrograde & Combustion

The Sanskrit verse:

Yada Vakri cha Astana cha Budho Bhavati Khecharan

Tada na Yujyate Tarko Vyavaharo Ati Viplavah

Translates functionally to:

“When Mercury is retrograde and combust, reason falters and commerce faces upheaval.”

Astrological Logic Mapping to Markets:

| Mercury Condition | Market Analogue |

|---|---|

| Retrograde | Reassessment, review, misinterpretation |

| Combust | Reduced visibility, obscured data |

| Combined | Breakdown in pricing logic |

3. Rahu in Aquarius: Speculative Amplification Cycle

Rahu symbolizes amplification, exaggeration, leverage, and illusion.

Aquarius symbolizes:

-

Collective systems

-

Innovation cycles

-

Electricity & networks

-

AI, digital platforms

-

Social contagion of ideas

Historical Rahu in Aquarius Cycles & Market Context

| Period | Market/Global Theme |

|---|---|

| 1969–1971 | Monetary breakdown, Bretton Woods collapse |

| 1988–1989 | Post-1987 volatility, Japanese asset bubble escalation |

| 2006–2008 | Housing/credit bubble climax |

| 2025–2026 | AI expansion, multipolar geopolitical stress |

Observation:

Rahu in Aquarius frequently coincides with speculative expansion phases in technological or financial systems.

4. 2026 Concentrated Air-Sign Mercury Retrograde Windows

Mercury retrograde & combust windows in 2026:

| Phase | Dates | Sign | Duration |

|---|---|---|---|

| I | Feb 26 – Mar 15 | Aquarius | 18 days |

| II | July 3 – July 23 | Gemini | 21 days |

| III | Oct 24 – Nov 12 | Libra | 20 days |

Unique Structural Feature:

All three retrogrades occur in air signs within a single year.

Air Signs Govern:

-

Information speed

-

Media influence

-

Technical trading

-

Speculative capital flow

-

Rumor propagation

Thus, 2026 stress centers around informational distortion rather than material production collapse.

5. Eclipse Corridor Effect (Feb 17 – Mar 3, 2026)

2026 Eclipse Events:

-

Solar Eclipse: Feb 17

-

Lunar Eclipse: Mar 2–3

Solar eclipses historically correspond with leadership or authority shock.

Lunar eclipses correlate with public sentiment inflection.

Historical Examples:

-

August 1999 eclipse preceded dot-com acceleration & volatility.

-

January 2019 eclipse cluster aligned with global growth scare.

-

June–July 2020 eclipse series overlapped pandemic volatility recovery extremes.

The February retrograde begins nine days after the solar eclipse and ends within the lunar eclipse shadow.

Layering Effect:

Eclipse + Retrograde + Combustion + Rahu = amplified uncertainty cycle.

6. Geopolitical Amplifier: U.S.–Iran Escalation

Current geopolitical environment includes heightened rhetoric and naval repositioning between U.S. and Iran entering early 2026.

Historical Precedent:

-

January 2020 U.S.–Iran confrontation → oil spike + equity pullback.

-

Gulf War periods aligned with eclipse corridors produced commodity volatility.

-

Middle East tensions frequently trigger liquidity hedging and defensive positioning.

When geopolitical escalation coincides with:

-

Mercury retro (miscommunication risk)

-

Rahu (fear magnification)

-

Air element stress (media amplification)

Markets historically exhibit:

-

Oil spikes

-

Defense sector acceleration

-

Currency volatility

-

Risk-off rotation

7. Historical Market Event Table

Below is a structured review of selected events linked temporally to Mercury stress environments:

| Year | Event | Behavior Observed |

|---|---|---|

| 1929 | Great Depression onset | Narrative collapse, panic selling |

| 1987 | Black Monday | Algorithmic cascade collapse |

| 2000 | Dot-com unwind | Valuation reset cycle |

| 2008 | Lehman crisis | Credit liquidity freeze |

| 2020 | COVID crash | Global correlation spike |

These were not single-factor events — but markets during communication breakdown phases showed abnormal nonlinear reactions.

8. Sector Sensitivity Matrix for 2026

Aquarius Phase (Feb–March)

-

AI

-

Tech conglomerates

-

Energy infrastructure

-

FinTech

-

PSU banks

Gemini Phase (July)

-

Media platforms

-

Telecom

-

Logistics networks

-

High-velocity trading firms

Libra Phase (Oct–Nov)

-

NBFCs

-

Forex & currency desks

-

Precious metals

-

Retail & FMCG

9. Behavioral Finance Overlay

Modern markets rely on:

-

Algorithmic trading

-

Narrative-driven flows

-

Options gamma positioning

-

Momentum strategies

-

AI-driven sentiment analysis

When information distortion increases:

-

Volatility clustering intensifies.

-

False breakouts multiply.

-

Liquidity dries temporarily.

-

Correlation spikes across assets.

2026 aligns more with information shock risk than structural credit crisis risk.

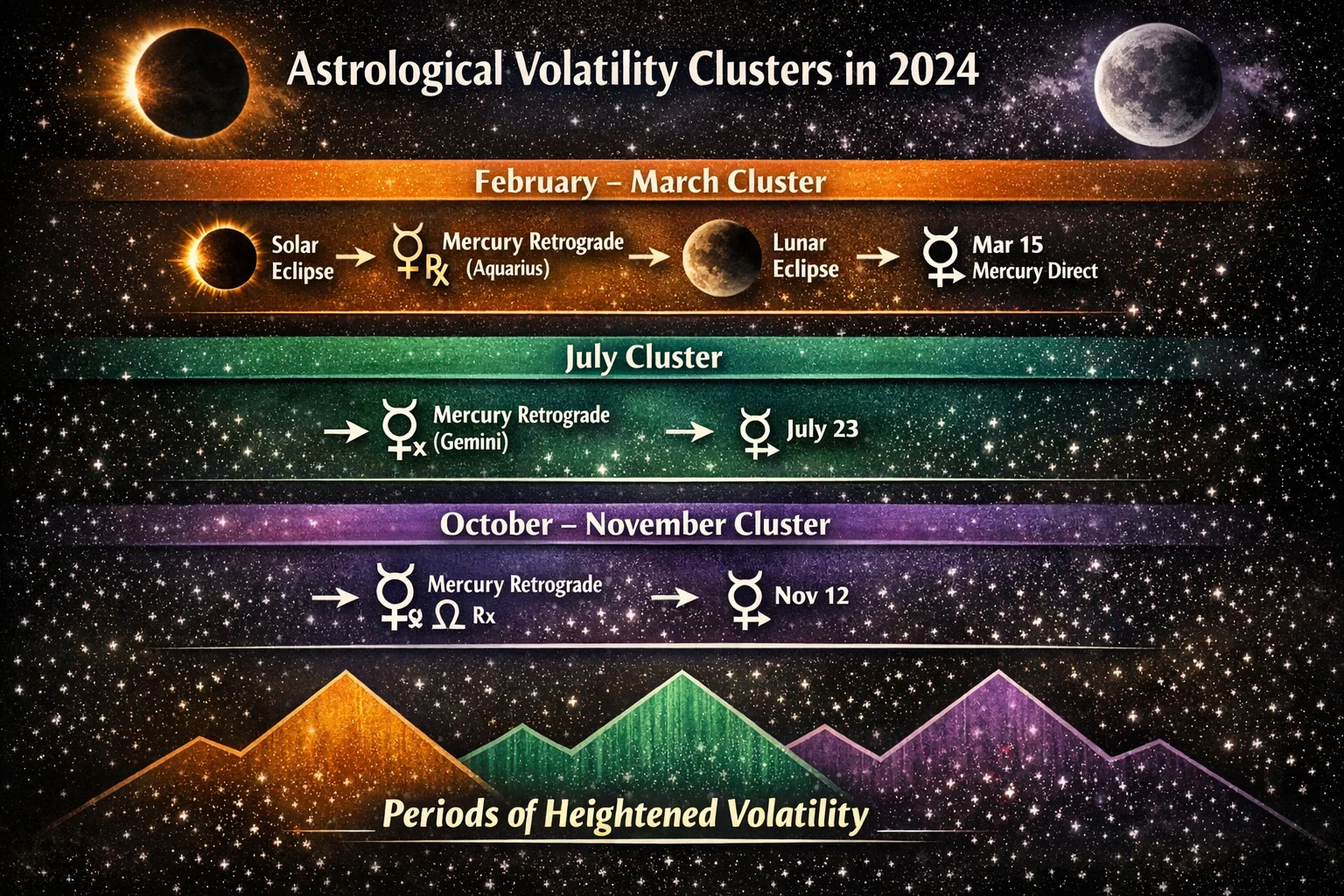

10. Visual Timeline Schematic

This creates three clear volatility clusters within one calendar year.

11. Academic Caution

Astrology must not be interpreted as mechanistic causation.

Macroeconomic Fundamentals Matter:

-

Interest rate cycles

-

Inflation data

-

Liquidity policy

-

Global trade volume

-

Corporate earnings

Astrology describes timing sensitivity windows.

It does not override fiscal or monetary policy.

12. Strategic Implications

2026 likely presents:

-

Elevated volatility probability

-

Increased narrative flips

-

Higher event-risk sensitivity

-

Reduced reliability of technical-only strategies

-

Greater importance of capital preservation

It does not inherently forecast:

-

A systemic crash

-

A guaranteed bear market

-

An economic depression

Rather, it resembles previous years where volatility increased due to narrative instability.

13. Conclusion

2026 contains a rare convergence:

-

Rahu in Aquarius (speculative amplification)

-

Three Mercury retro/combust air sign phases

-

Eclipse corridor convergence

-

Active geopolitical escalation

This alignment suggests:

Heightened sensitivity.

Accelerated sentiment shifts.

Rapid repricing risk.

The correct institutional response is risk structuring — not predictive panic.